At the beginning of 2024, the global economic situation and revenue status of various industries faced unprecedented challenges. Business development entered a stage full of hardship, while the transformation period of industries brought pain and uncertainty, triggering a widespread phenomenon of “involution.” The key to solving this problem lies in first understanding what the fundamental meaning of “involution” is.

The trend towards downgrading and rationalization of consumption has led to a decline in consumers’ willingness and ability to pay, forcing many industries to adopt price reduction strategies. At the same time, consumers’ demand for product quality, service convenience, and professionalism is on the rise, forming a trend of quality improvement and upgrading across various industries. These two opposing trends—improvement in quality and reduction in price—have brought survival difficulties to companies. Many have seen a decline in gross profit margins or have even left the market competition.

In this situation, “platform ecology” has become a new path explored by many companies. It transforms the traditional “competition” model into “co-opetition,” utilizing digital intelligence technology. While ensuring quality improvement and cost-performance upgrades, it meets the strict demands of consumers and becomes a mainstream force in the supply-side upgrade.

I. China’s market is experiencing the era of super involution with quality improvement and price reduction

1. Starting with Xiaomi’s car manufacturing

On March 30, 2021, Lei Jun announced Xiaomi’s entry into the car industry. By December 28, 2023, the Xiaomi Su7 was unveiled, with Lei Jun expressing the ambition to become one of the top five car manufacturers in the world within 15 to 20 years and to strive for the rise of China’s automotive industry. The new energy vehicle market is far from a blue ocean, with fierce competition. Facing such a complex market environment, Xiaomi still chose to enter the automotive industry.

The launch of Xiaomi cars is Xiaomi’s biggest expansion in its ecosystem, with its strategy upgraded to a “person-car-home” whole ecology in 2023, intending to build an ecosystem around everyday life scenarios. The automotive industry is an important segment in intelligent living and a key area in the industrial internet revolution. If Xiaomi cannot make inroads in the automotive sector, its future influence and sustainable development potential will be significantly reduced. Lei Jun openly said: “The market competition is exceptionally brutal, and the price war is just one of the competition methods, products, technology, and ecology are the key advantages.” He believes that Xiaomi’s advantages lie in its intelligence and ecology, which may provide Xiaomi with opportunities for breakthroughs in the new energy vehicle sector, becoming an important participant in the industry. In comparison, those companies that only focus on a single car category may face more pressure in the future.

2. Severe cyclical changes and intense involution competition in China’s various industries

“Involution” has become one of the most important topics in China’s various industries from the past year or two up to the next three to five years.

In the e-commerce field, a phenomenon that has attracted much attention is that Pinduoduo’s market value has surpassed Alibaba’s. Pinduoduo represents those platforms that can meet the trend of consumption downgrading while still providing products with a decent quality and cost-performance ratio, becoming the preferred choice for an increasing number of consumers.

In the new retail industry, Hema Fresh, one of the pioneers of new retail, is also facing fierce challenges and necessary transformation. Due to the failure of the Hema Mountain Moving project and the subsequent departure of founder Hou Yi, Hema began to focus on lowering prices, improving product quality, reorganizing the supply chain, and reconstructing its digital infrastructure.

In the content industry, ByteDance, which operates with a user-generated content (UGC) model, has surpassed Tencent, which relies on professionally generated content (PGC). By empowering users with AI technology, they have surpassed the old model that depended on professional producers for producing professional content including news, publishing, and games. This symbolizes the rise of a user revolution, with users beginning to dominate the productivity of the content industry.

This shift further validates the construction of an innovative ecosystem based on user customization and participation, which will become a mainstream trend in many industries. In the fashion industry, SHEIN has shifted from a self-operated model to a platform-based marketing strategy, strengthening its cost-effective operation strategy, and has achieved tremendous success. SHEIN updates its products faster than fast fashion leaders like Zara, demonstrating that the entire apparel industry is moving towards further specialization, digitalization, and platformization.

In the fitness industry, Keep Fitness expects an explosive increase in the number of its fitness stores to over ten thousand within the next three years, marking the leading position of new fitness enterprises that rely on platforms and digitalization within the industry. In contrast, traditional fitness brands like Impulse have mostly gone bankrupt or are nearing such a state.

In the home furnishings sector, I often advise the boards of the home furnishing companies I serve to pay close attention to the current wave of full-decoration industry trends and the impact of platforms like Beike on the entire industry. Beike Home Decoration’s revenue exceeded 13.3 billion in 2023, making it the industry’s brand of choice. It has had a profound impact by entering the home retail field through home decoration and real estate retail. The two retail giants of the home industry, Red Star Macalline and Easyhome, due to the opacity of their offline models, are gradually declining. They face a trend of falling behind in traffic competition to decorating companies and platforms like Beike, leading to operational difficulties.

The above cases demonstrate a common trend in many industries: extreme cost-effectiveness, high specialization, and deeper and pickier demands. This has led to industry restructuring with new supply forces often being industry internet platform enterprises with digital intelligence in their DNA. They are replacing traditional, opaque, offline businesses, and companies centered around traditional solutions. Nearly every industry is undergoing such a transformation.

In the Chinese market, lowering prices and improving quality is a significant trend, influenced by four major forces: First, in terms of economic expectations, the macro environment over the next two to three years is viewed with pessimism.

As the structure of global trade shifts and the reliance on low-cost labor development mode changes, we are experiencing a fundamental transformation of the economic and industrial cycle. This shift in cycle leads to generally lowered consumption expectations, not just from ordinary C-end consumers, but also B-end corporate clients who are more cautious with investment and consumption. The general cautious consumer mentality and less optimistic expectations will inevitably push most industries to be more prudent in pricing strategies, profoundly affecting companies’ gross margin levels and increasing the demand for product cost-effectiveness.

In consumer behavior patterns, as people transition from initial consumption to repeated consumption, consumers become more rational and demanding. Initially, marketing messages might significantly influence their first purchase decision, but as they shift to repeated consumption, they display a high level of rationality and expertise. The generalization of this strict, extremely rational consumption pattern is causing profound shifts in nearly all industries and significantly impacting the overall industry landscape.

Technological innovation plays a key role in the upgrading of industrial infrastructure and the transformation of the value chain. In an environment supported by traditional industrial technology, it was difficult for products to meet the demand for both low cost and small batch production. However, today’s technological revolution provides a solution to this dilemma. Firstly, the innovation of new materials offers a variety of cost-effective alternative materials for production; secondly, the development of the industrial internet makes personalized customization and large-scale production no longer contradictory. As a result, a triangle of high quality, low cost, and convenient service — which was previously considered impossible — is now attainable in many industries through technological transformation.

More and more innovators are emerging in various industries, quickly identifying the compromises and dissatisfaction of industry users, as well as the pain points of inefficiency. In today’s era of transparent information, these dissatisfactions and pain points become the targets for entrepreneurs to disrupt established industries, thereby promoting a wave of innovative enterprises that challenge existing industry leaders. This not only shakes the status of industry leaders but also establishes innovators as the force that disrupts traditional industries.

In the process of widespread consumption adoption, three different eras have been experienced:

Manufacturer-Led Era: In the 1980s and 1990s, manufacturers dominated and captured most of the value in the industry chain. Agents would queue up at factory gates to pick up goods, and as long as manufacturers produced high-quality products, they could attract a steady stream of agents for purchasing.

Channel-Led Era: From the 1990s to the early new millennium, as production and sales began to balance, retail and distribution channels became the key to winning. During this period, production began to exceed sales demand, and traders capable of efficiently reaching consumers emerged like bamboo shoots after a rain. They dominated the industry and captured most of the profits.

User-Led Era: Entering the era of repeat consumption, consumers have become more rational. With the development of digital technologies, the distance between consumers and products has greatly narrowed. Users can understand the functions and features of products more deeply and directly assess the relevance of products’ expertise to their personal needs. The information gap has been eliminated, placing users and manufacturers in an equal information environment, thus giving rise to a new era where the consumer is king.

In today’s consumer-centric era, consumers play a dominant role in the value creation process of industries. For retailers and manufacturers, this means they will face increasingly squeezed profit margins. This is a common situation across many industries, and the continuous compression of profit margins is an unavoidable issue for them.

Therefore, building a high-dimensional platform ecosystem has become the necessary path for companies to cope with low-dimensional vicious competition and to break away from the so-called “red sea” involution. Companies must develop in high dimensions, which requires not only lowering costs and increasing scale but also accumulating other forms of competitiveness. Through the empowerment of these diversified competitive forces, companies can achieve a fusion of cost-effectiveness and specialization, thus standing out in market competition.

The path to high-dimensional evolution has two main directions: firstly, to enhance user value, and secondly, to reduce costs and realize diversified cost-sharing. Companies that choose to develop in high dimensions can have more sources of competitiveness and a wider range of cost-sharing methods, which greatly increases the possibility of creating more value for customers. These high-dimensional species possess more effective cost-sharing and value-creation capabilities, and their competitive strategies, compared to the past, are no longer on the same level, and can form what is known as “dimensionality reduction attack.”

From initially focusing only on the stable quality of a single category to now managing multiple categories, companies have shared the operating costs of the entire system through various products and services, achieving a stronger cost-sharing ability. Further, if a company evolves into a platform with network effects, every user on the platform can create connections and add value, and the addition of new users brings more value to existing users, thereby strengthening the cost-sharing ability of network effects.

As the dimension of competitiveness increases, companies will enhance their ability to create customer value and share costs, which will give them stronger market competitiveness and the ability to offer products and services that are highly cost-effective and specialized. Moreover, high-dimensional competition not only manifests in creating higher user value but also achieves lower cost-sharing.

In the business field, the platform ecosystem is a typical manifestation of high-dimensional competition, combining four major competitive forces:

- Full-category scale economy: The larger the scale of the product, the lower the cost.

- Borderless range economy: The more product categories, the more costs can be reduced, and the more value can be created for customers.

- Complex multi-sided network effects: The more participants on the platform, whether users or producers, the greater the value brought to each participant, and hence the more significant the cost-sharing effect.

- Ecosystem lock-in: In a high-quality platform ecosystem, participants are locked in and cannot disperse across multiple platforms, and are closely tied to the platform, making it difficult to switch to other competitors’ platforms.

This high-dimensional development model, through various means, realizes cost-sharing and user value creation, allowing companies to maintain specialized competitiveness and high cost-effectiveness even in a fiercely competitive environment.

To achieve the ultimate in customer value and maximize market competitiveness, the primary factor lies in the scale of the platform ecosystem. The larger the scale, the higher the cost-performance ratio that can be achieved because the output cost of each category can be reduced through economies of scale. Platforms that can cover the global market have the greatest scale economy effect, thus achieving the lowest cost.

Additionally, infrastructure transformed by digitalization, including shared facilities such as production, research and development, and logistics, can further reduce costs by serving multiple categories. This multi-category cost-sharing mechanism not only enhances the cost-performance of each category but also strengthens the overall economic benefits, promoting the long-term development of enterprises.

Strategy for Building Scenario-based All-categories and Their Extensions

Creating scenario-based all-category services and their extensions is the strategic core for offering top convenience value. Haier’s “Internet of Food” initiative is to upgrade the single refrigerator product category to form solutions around how consumers match fresh ingredients to create daily meals. Undoubtedly, only on the basis of constructing a complete ecosystem and a package of solutions can scenario-based all-categories be deeply integrated and used with the utmost convenience.

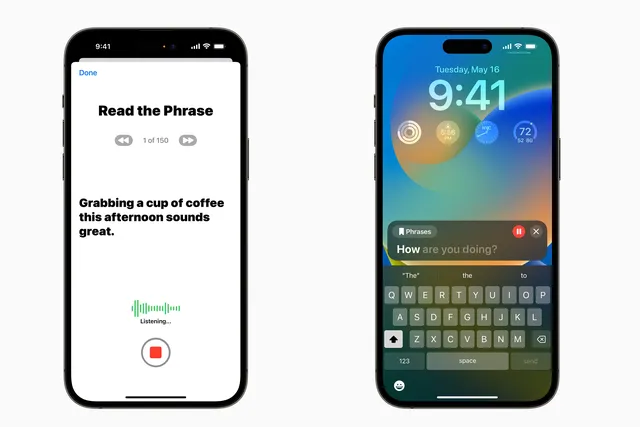

Realizing Value of Deep Customization through Comprehensive Interconnectivity and Immediate Intelligence

Comprehensive interconnectivity and immediate intelligence allow all participants in the platform ecosystem to interact online in real-time. Such technical support ensures dynamic iterative updates of data and decisions can be made promptly, truly reflecting efficient and instant interconnectivity. Users’ needs can receive real-time feedback, which is also an important prerequisite for achieving deep personalized customization and innovation value.

The Evolution of Customer Value Brought by Ecological Openness and Dynamic Absorption

In an open platform ecological environment, once a supplier of a certain category fails to meet high standards, other excellent providers will quickly take its place. This dynamic renewal and iteration keep the platform vibrant and continuously enhance the customer’s value experience.

Re-defining Core Category Markets and Competitive Strategy of Ecological Extension Categories

To enhance the market competitiveness of the platform ecosystem, the core is to redefine and innovatively reshape the main category markets, which will have a lasting impact on market competition. Taking Xiaomi as an example, after strengthening the mobile phone business, it turned to the power bank market, greatly impacting traditional enterprises with its astonishing brand power and user loyalty, forcing competitors to either exit the market or join its ecosystem.

Key Strategies for Locking Customers and Ecosystem Partners

A platform ecology that truly connects the industrial internet with the consumer internet can firmly lock in customers, incurring high transfer costs. Providers that rely on the platform’s ecosystem will find it difficult to operate independently of the platform, showing a strong locking effect on partners.

Key Elements for Future Success of Enterprises

Strategic ecologization, based on specialized infrastructure, is an inevitable trend, enterprises should shift from pipeline models to platform-based ecological models and empower their ecosystems through infrastructure to achieve infinite scalability.

Organizational platformization is a supplement to strategic ecologization, it signifies a shift from closed and rigid organizational forms to open and dynamic platform-style innovative organizations.

Core Talent Transformation in Platform Ecological Enterprises: In platform ecological enterprises, core talent should be co-creating partners with professional skills rather than merely employed staff. Such talent should move from traditional highly controlled, performance-driven models to freely combined, mission-driven partnership talent.

Leadership Empowerment Transformation: For leaders, the most critical transformation is the shift from a control model to an empowerment model. Leaders should build solid infrastructure and nurture professional capabilities to empower the ecological partners within the platform. The past authoritative-centered, centralized decision-making leadership style should shift to a co-creating leadership model that spreads the mission, empowers employees, and responds agilely.

Intelligent Upgrade of Operations: Intelligent operations are an inevitable trend for the future development of enterprises, which require the comprehensive integration of digitization, artificial intelligence, and the internet. Enterprise operations should upgrade from the traditional man-machine collaboration model to a highly integrated AI technology and human collaboration model.

Social Integration of Elements: Enterprises’ capabilities and resources should be integrated through social means. A true platform is not limited to within the enterprise, but should also integrate into a broader social ecology. Through open interfaces or digital connections, enterprises can effectively link with social ecological elements, thus changing the model of acquiring production elements from simple transactions to partnership relationships, and achieving external empowerment of infrastructure and positive external effects.

Framework Overview of the Platform Ecological Model: After long-term research and practice, Zhì Yì Consulting proposed a high-quality platform ecological framework model called the “two-sided, three-ended”: the S-P-B-P-C model. In this model, S stands for the resource end, which includes all resources and capabilities owned or obtained externally by the enterprise; B is the supply end, which consists of the solutions ecology formed by products and services provided by various participants; C is the demand end, composed of all target consumers. The industry interface (S-P-B) is the connection point where the platform enterprise empowers the participants within the ecosystem, while the user interface (B-P-C) is the channel through which the supply end outputs products and services to the demand end. Taobao, for example, practices the B-P-C model by building a connection between B and C ends, as opposed to a simplistic B to C retailer model. At the industry interface, the platform ecology isn’t about creating a simple S to B model; rather, it’s about creating a connection platform between production elements and producers to craft the S-P-B ecology.

The “Three Major Barriers” Faced by Platform Transition:Traditional pipeline companies face key issues in upgrading strategic forms, reconstructing organizational forms, and strengthening digital intelligence in their transition to platformization.

- Upgrading Strategic Forms:Strategic upgrade of platform transformation necessitates fundamental changes such as shaping new missions and innovating new values, shifting from focusing solely on user needs to addressing the needs of both users and all platform participants, and evolving from single-point innovation to deeper, customized value creation.

Building New Infrastructure:In the digital age, the upgrade of infrastructure is crucial to meet the increasing and complex demands of consumers. The focus has shifted from traditional closed pipeline value chains to open value networks with shared digital smart facilities at their core. This transition leads to high-quality growth of both user value and platform ecology.

Opening and Integrating New Supply:The supply model is evolving from fixed-category solutions to integrated solutions across multiple scenarios and fields. Haier’s Internet of Food is a typical example of cross-boundary integration, comprising refrigerator manufacturers, kitchenware suppliers, food suppliers, and providers of cooking solutions for different cuisines, pooling all products and services onto the same ecosystem platform to achieve a one-stop, customized, cross-boundary solution.

Four Key Elements to Building a Platform Organization:

- Constructing a Platform Organization Structure:Organizational structures are shifting from the traditional “pyramid” to an “inverted pyramid” platform framework.

- Implementing High-Energy Incentives:The transformation of incentive mechanisms from mid-short term KPI-centric approaches to long-term incentives based on assets like shares and options, sharing value growth, and securing talent.

- Building an Open Talent Ecosystem:For successful enterprise construction, the socialization of talent is equally important. Building an open talent ecosystem fosters the development of the R&D and production network.

- Creating Co-creative Leaders:The role of leaders needs to transform into an empowering and co-creative leader.

Digital Intelligence Technology Transformation:Technological transformation needs to occur on multiple levels. First, by creating real-time online physical entities, transforming traditional non-digital entities into digital ones. Then, by revolutionizing infrastructure to build a complete Internet of Things infrastructure, or IaaS. Moreover, upon this foundation, establish various types of platforms, such as R&D, manufacturing, and logistics platforms, forming a platform layer. Above this layer, develop applications tailored to different users and scenarios, namely SaaS. These levels of transformation build a strong competitive edge and an efficient operating platform ecosystem.

Case Study of Xiaomi’s Platform Ecosystem Evolution: Xiaomi’s development vividly demonstrates the evolution of a platform ecosystem. It initially began by combining hardware, software, and internet experiences, evolving into an integration of the internet and new retail models, and now centers around smartphones and AIoT. Xiaomi is currently advancing towards a strategic upgrade of an “All-encompassing Ecosystem for People, Vehicles, and Homes.”

Xiaomi Corporation consistently adheres to its high-level strategic system, which includes its widely embraced corporate mission—to create compelling, affordably-priced quality products that enable everyone around the globe to enjoy the wonderful life that technology brings. Additionally, Xiaomi holds the vision to “be friends with our users and be the coolest company in our users’ hearts,” along with its “honesty and passion” values, aiming to treat users and ecological partners with sincerity, have fervent love for national products, and shoulder the responsibility to propel the rise of Made in China.

The establishment of Xiaomi’s Open Ecosystem Chain Model is a multi-layered, interconnected system. It starts with its core offerings: smartphones, vehicles, and TVs, which form the foundation of the complete ecosystem connecting people, cars, and homes. It then expands outward to peripheral products related to phones and cars, smart accessories, household items, and even further to a range of derivatives such as furniture, together comprising the full Xiaomi ecosystem. The inherent connective tissue of Xiaomi’s ecological chain stems from a consensus on its mission, vision, and values, enabling each member to identify with, deeply understand, and adopt Xiaomi’s core philosophy. On the other hand, through capital injection and the empowerment of industrial infrastructure, Xiaomi helps ecological chain partners to innovate and develop independently.

By investing in and taking stakes in external entrepreneurial teams, Xiaomi facilitates their rapid growth and acquires excellent creative projects at a lower cost, thereby swiftly capturing market opportunities. At the same time, Xiaomi empowers ecosystem enterprises in key fields such as product definition, industrial design, supply chain, channels, and branding, helping them to achieve rapid success.

Empowerment by Xiaomi to its Ecological Chain starts with its core products—Xiaomi smartphones, Xiaomi TVs, Xiaomi cars—using the blockbuster effects shaped by these products and the resources and capabilities that have been accrued. Subsequently, infrastructure empowerment involves transforming the infrastructure and capabilities formed by core products through central platform restructuring, and providing open enabling services to ecological chain enterprises. Xiaomi maintains full openness towards non-core categories of business, bringing in strong partners, which has led to a range of star products such as mobile power banks, air purifiers, wristbands, water purifiers, smart robots, and smart home devices.

By 2018, Xiaomi was the first to achieve the goal of investing in one hundred ecological chain enterprises within five years, penetrating into 100 niche markets with this model, driving forward the intelligent hardware industry. By 2023, the number of devices connected to Xiaomi’s AIoT exceeded 655 million, holding the global lead. In terms of governance, Xiaomi applied a multi-level open ecological approach, adopting different incentives and management methods for core, complementary, and derivative products, emphasizing the importance of simultaneously focusing on the core products while remaining open to supporting product categories.

Xiaomi has injected capital and industrial chain resources into the ecosystem of complementary and derivative products, opting to participate through shareholding rather than control, thereby preserving the entrepreneurial spirit and creative passion of startup teams, which in turn has driven the expansion of product scale and cemented the industry position.

The ecological organization upgrade of Xiaomi’s platform is a process that took place in stages. The first stage was the simple organizational form prior to 2012, followed by a shift to a divisional structure from 2012 to 2018, during which Xiaomi focused on building strong core categories such as mobile phones and TVs.

At the end of 2018, Xiaomi initiated a significant organizational transformation, officially moving towards an ecologically-oriented layout. While solidifying its core product lines, Xiaomi also constructed numerous support platforms, extending resources and capabilities to ecosystem partners. The heart of this transformation is the establishment of a powerful ecological chain department—a empowerment system, along with a cooperative governance architecture that includes multiple committees.

Xiaomi’s ecological chain operates on the S-P-B-P-C model. The S-end is the ecological resource pool, which includes investors, manufacturers, designers, and other industrial resource participants, providing diverse industrial capabilities to the platform. Next, through establishing investment interfaces, supply chain interfaces, and quality control interfaces, it provides pathways for the B-end to connect resources. At the B-end, Xiaomi has invested in more than 300 ecological chain enterprises, covering not only core products in which Xiaomi is deeply involved, such as mobile phones, automobiles, and speakers, but also derivative and complementary product categories, and even some enterprises are diversified categories with only minor investments without holding control.

Xiaomi has built various user interfaces with C-end users, such as the APP store, Xiaomi Mall, Xiaomi Youpin, and Xiaomi Home. C-end users are further segmented into seed users, opinion leaders, Mi fans, and ultimately the general consumers, ensuring Xiaomi can reach user groups accurately and effectively.

Four pieces of advice to entrepreneurs:

- First, either create your own ecosystem or join someone else’s. In today’s society, where internal competition is fierce, consumer demands are upgrading, and digital technology is continuously driving business innovation. It requires businesses to either become providers of ecosystems or a part of one or otherwise face survival challenges.

- Second, without solid products, the platform ecosystem cannot grow healthily. Lacking one or two deeply cultivated and specialized core categories as support, the platform lacks quality assurance. A high-quality platform ecosystem must establish high-standard delivery rules on core products and build a solid industrial infrastructure.

- Third, businesses need to balance focusing on core products and broadening the openness of the ecosystem. Managing how depth and breadth coexist is an art of balance. Specialization depth and high quality are the foundation of the ecosystem, while the extension of the ecosystem requires extensive connections.

- Fourth, digital technology is the fundamental soil for building a healthy, prosperous, and sustainably evolving ecosystem. The prosperous ecology of the future cannot be separated from the embrace and importance of digital technology, which is an indispensable important technology for building a future prosperous ecology.

Hope every entrepreneur can embrace the concept of platform ecology, break free from the constraints of singular competition and involution, and become the new industry leader in the digital era.